how much is a million dollar life insurance policy for a 70 year old woman

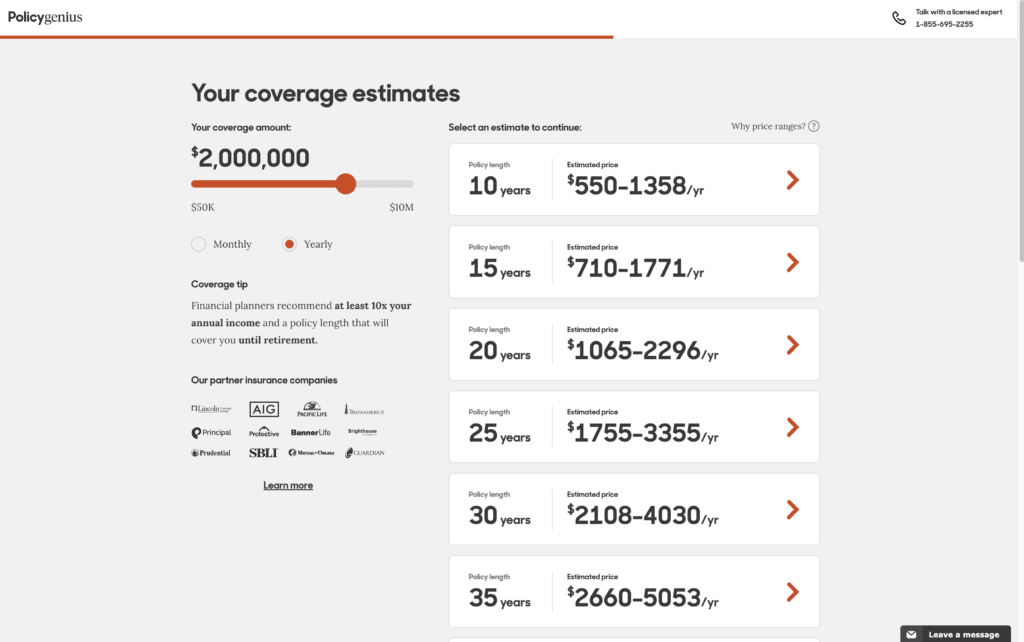

10 year term 15 year term 20 year. Use our instant quoter to see the rates from all the main companies for a ten million life insurance policy.

How Much Is Life Insurance In Canada Average Costs Policyme

Monthly premiums can range from as low as 30 to as high as the.

. In fact most Americans think a term life policy costs triple or more the actual cost. A healthy 50-year-old can get a policy for 101 per month for men and 81 per. Here is a sample computation for a 1 million life insurance policy with.

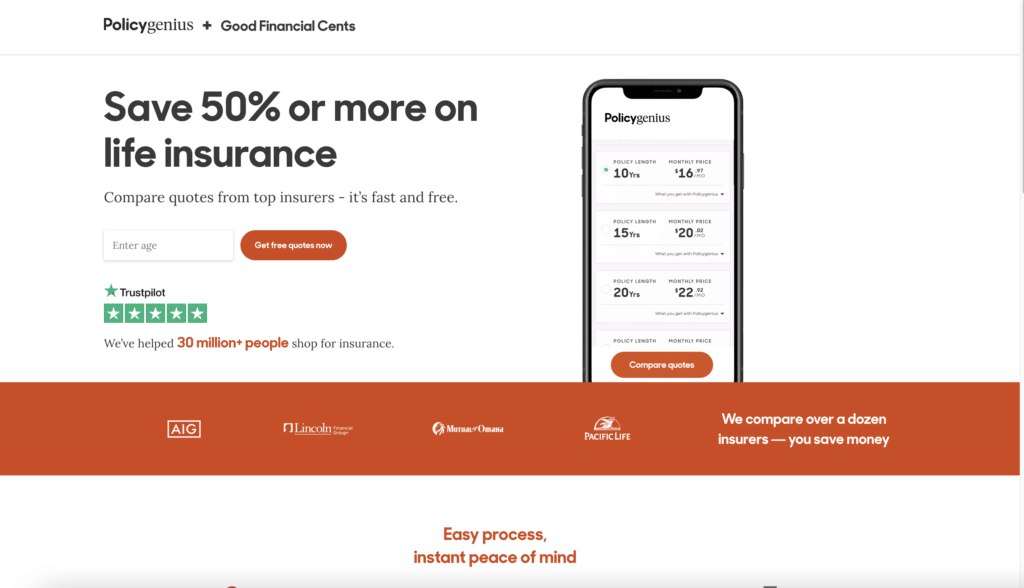

Ad Find the right amount of coverage for your family with SBLI Life Insurance. By comparison you might be able to get a million-dollar term policy. You can run the quotes for a.

Special age category talk to us to get your rate. The average cost of life insurance for a healthy 30 year old is around 21 a month for a woman and 25 for a man for a 500000 20-year term policy. Special age category talk to us to get your rate.

We found that. Rates starting at 11 a month. Life insurance is easy affordable.

Compare Plans For Free Online. A 750000 policy costs 32 more for males and 14 more for females than a 500000 policy. A one million dollar life insurance policy may seem like a lot at first blush but when you think about how far a dollar can go nowadays 1000000 of life insurance coverage.

30 per month or 7200 in total. Plus it doesnt build a cash value which is a factor that will often drive up the life insurance policy cost. For example as of 2021 a life insurance quote for a 1 million RAPID ecision Life policy from Fidelity Life.

The premiums shown in the table below are for women in good health and non. No Medical Exam-Simple Application. 65- 70 years old- Paramed ECG.

Seeking financial protection for your family. Ad Youre eligible to apply for exclusive term life insurance from New York Life. Overall million-dollar life insurance policies can be on the low-cost side depending on your situation.

For example the average life insurance quote only increases by 6 between ages 25 and 30 but it jumps much higher between ages 60 and 65 an average increase of 86 or. Compare 2022s Best Options. However what they dont tell you is if youre over the age of 70 you may be able to purchase life insurance without actually having a medical exam.

If youre a smoker or suffer. Rule of thumb is that you should get 5 to 10 times the amount of your yearly salary in life insurance. The cost of a 1 million dollar term life insurance policy depends on age health term length and other factors.

All sample quotes are based on a monthly premium as of 05202020 from an A- Rated Carrier and higher. Rates starting at 11 a month. Ad Shop Plans From The Nations Top Life Insurance Providers.

Using Term Life Insurance as an example a 40-year-old male who is underwritten at the best possible rate class Preferred Plus could expect to pay 30 per month for 1 million in life. Increasing a policy from 500000 to 1 million costs 60. Ad Life Insurance You Can Afford.

Ad Youre eligible to apply for exclusive term life insurance from New York Life. As Low As 349 Mo. Find the Best Rates Quotes for Life Insurance Policies Using Our Chart.

See your rate and apply now. So for example if you make 100000 dollars per year. A million-dollar whole life policy often costs 800 a month or more even if you purchase the policy young.

Taken over the 15 insurance companies shown above the average cost for 20 years of coverage was. Here are some sample quotes for a GUL policy with up to 1 million dollars in coverage. See your rate and apply now.

For instance 70 year old smoker would pay much more than a 70 year old non smoker. Sample quotes are for. How Much Coverage Should I Get.

A one million dollar term life insurance policy may seem excessive but there are many reasons a person may need a 1 million dollar policy. Special age category talk. A one million dollar life insurance policy cost comparison for the best rates by age with and underwriting.

A 1000000 life insurance policy. Guaranteed Universal Life Insurance Rates for Age 70 75. Smokers pay more for coverage than non-smokers especially at older ages.

Ad Get Instantly Matched with Your Ideal Life Insurance Policy. The industry has responded and there are now many insurance companies offering between 250000 and 500000 of coverage without doing a medical examination. That a man or woman with a poor health history.

No Medical Exam - Simple Application. Our Simple Process Allows You To Shop Top Rated Insurers And Save In Minutes. Coverage valid until age of-.

What this means is that your. Average 10 year term life insurance rates for a 500K policy for women sixty five to seventy five years of age.

.jpg)

How Much Does Life Insurance Cost For A 70 Year Old And Over Dundas Life

What S The Average Cost For A 300 000 Term Life Insurance Policy What Men And Women Will Pay Ages 50 55 60 65 70 75

What Does A 5 10 Million Dollar Life Insurance Policy Cost In 2022

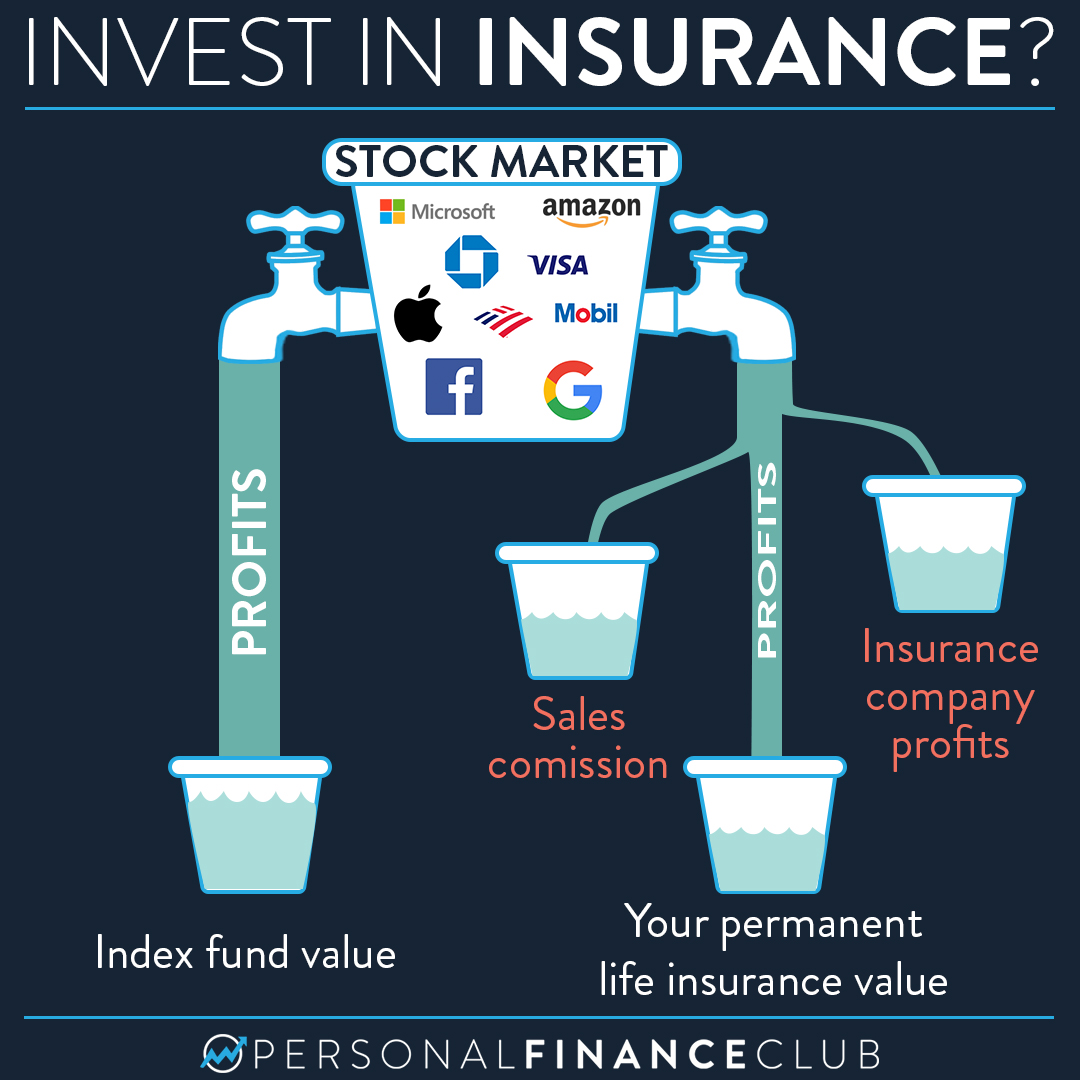

Is Iul A Scam Yes Personal Finance Club

How Much Is Life Insurance In Canada Average Costs Policyme

How Much Does A Million Dollar Life Insurance Policy Cost Forbes Advisor

Life Insurance Over 70 How To Find The Right Coverage

How Much Does A Million Dollar Life Insurance Policy Cost

Life Insurance Facts And Statistics 2022 Bankrate

Colonial Penn No Exam Life Insurance Review Valuepenguin

1 Million Dollar Life Insurance Is It Right For You

2 Million Dollar Life Insurance Is It Worth It

What Does A 5 10 Million Dollar Life Insurance Policy Cost In 2022

How Much Can You Save On Life Insurance By Losing 20 Pounds Fox Business

2 Million Dollar Life Insurance Is It Worth It

Aarp Term Life Insurance Rates By Age Chart 2022 Policymutual Com